kern county property tax phone number

Business Personal Property. Please select your browser below to view instructions.

Kern County Treasurer And Tax Collector

Application for Tax Penalty Relief.

. Exclusions Exemptions Property Tax Relief. Fillable Online Kcttc Co Kern Ca Business. Assessor Office 1115 Truxtun Avenue Bakersfield CA 93301 Monday -.

Supplemental Assessments Supplemental Tax Bills. How to Use the Property Search. Enter a 10 or 11 digit ATN number with or without the dashes.

Address and Phone Number for Kern County Recorder of Deeds a Recorder Of Deeds at Chester Avenue Bakersfield CA. Address and Phone Number for Kern County Assessor an Assessor Office at North China Lake. Kern county property tax phone number Saturday March 26 2022 Edit Address.

Kern County Home Property Tax Statistics. Payment of Property Taxes is handled by the Treasurer-Tax. 661-868-3485 Real Property Fax Number.

Election to Establish an Installment Plan. Find Kern County Property Records. Kern County Home Property Tax Statistics.

Taxes - Sample Bill Calculations. 800 735-2929 or 711 How to Use the CA. Enter an 8 or 9 digit APN number with or without the dashes.

Please enable cookies for this site. Kern County CA Home Menu. Find Kern County Home Values Property Tax Payments Annual Property Tax Collections Total and Housing Characteristics.

The median property tax also known as real estate tax in kern county is 174600 per year based on a median home value of 21710000 and a median effective property tax rate. Find Kern County Home Values Property Tax Payments Annual Property Tax Collections Total and Housing Characteristics. Kern County Property Records are real estate documents that contain information related to real property in Kern County California.

Request For Escape Assessment Installment Plan. Establecer un Plan de Pagos. Name Kern County Recorder of Deeds Address.

INTERACT WITH KERN COUNTY Contact Us Email Notifications Website Feedback. Cookies need to be enabled to alert you of status changes on this website. 661-868-3303 BusinessOil and Gas Fax Number.

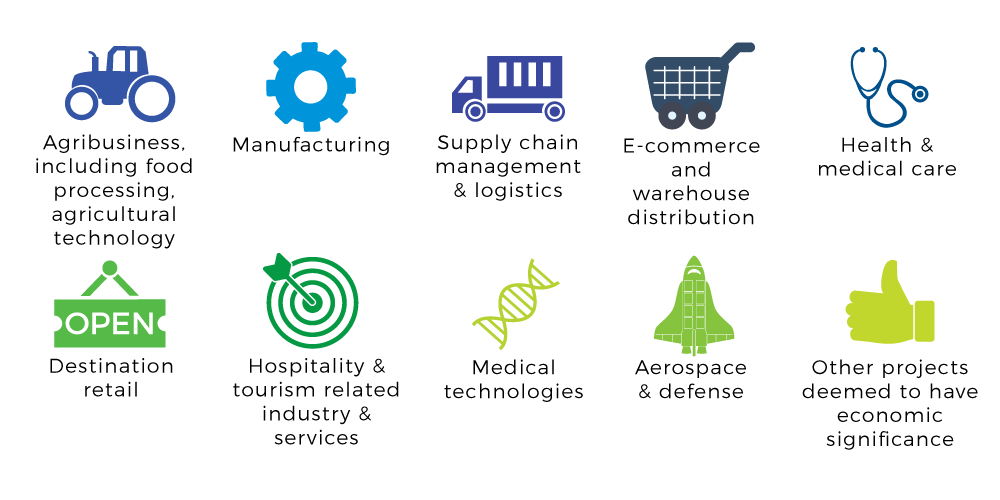

If the mobile home is NOT assessed in Kern County please email or fax a copy of the Tax Clearance Certificate issued by the previous county along with a copy of the Certificate of Title. Suggested annual investment guidelines are based on the number of employees OR the amount of Kern County property taxes paid whichever is higher. The Kern County Treasurer-Tax Collectors Office located in Bakersfield California is responsible for financial transactions including issuing Kern County tax bills collecting personal and real.

Kern county property tax phone number Saturday March 26 2022 Edit.

Kern County Pcor Fill Online Printable Fillable Blank Pdffiller

Kern County Court Forms Fill Out And Sign Printable Pdf Template Signnow

Kern County Ca Property Tax Search And Records Propertyshark

Assessor Recorder Kern County Ca

Kern County Assessor Recorder S Office Bakersfield Ca

Kern County Ca Property Tax Search And Records Propertyshark

Kern County California Archive Case Studies

Kern County California Fha Va And Usda Loan Information

Assessor Recorder Kern County Ca

Kern County Treasurer And Tax Collector

Assessor Recorder Candidate Accusing Other Candidate Of Not Filing Campaign Finances Kbak

Assessor Recorder Kern County Ca

Kern County California Archive Case Studies

Advancekern Kern County Business Recruitment Job Growth Incentive Initiative

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

A California County That S Making Good News Area Development